We would like to inform you about the evolving landscape of global trade policy, particularly the recent changes in U.S. tariff structures, and the potential implications for your supply chain. As your trusted logistics partner, it is our priority to ensure transparency and provide strategic insights to help you navigate this complex environment.

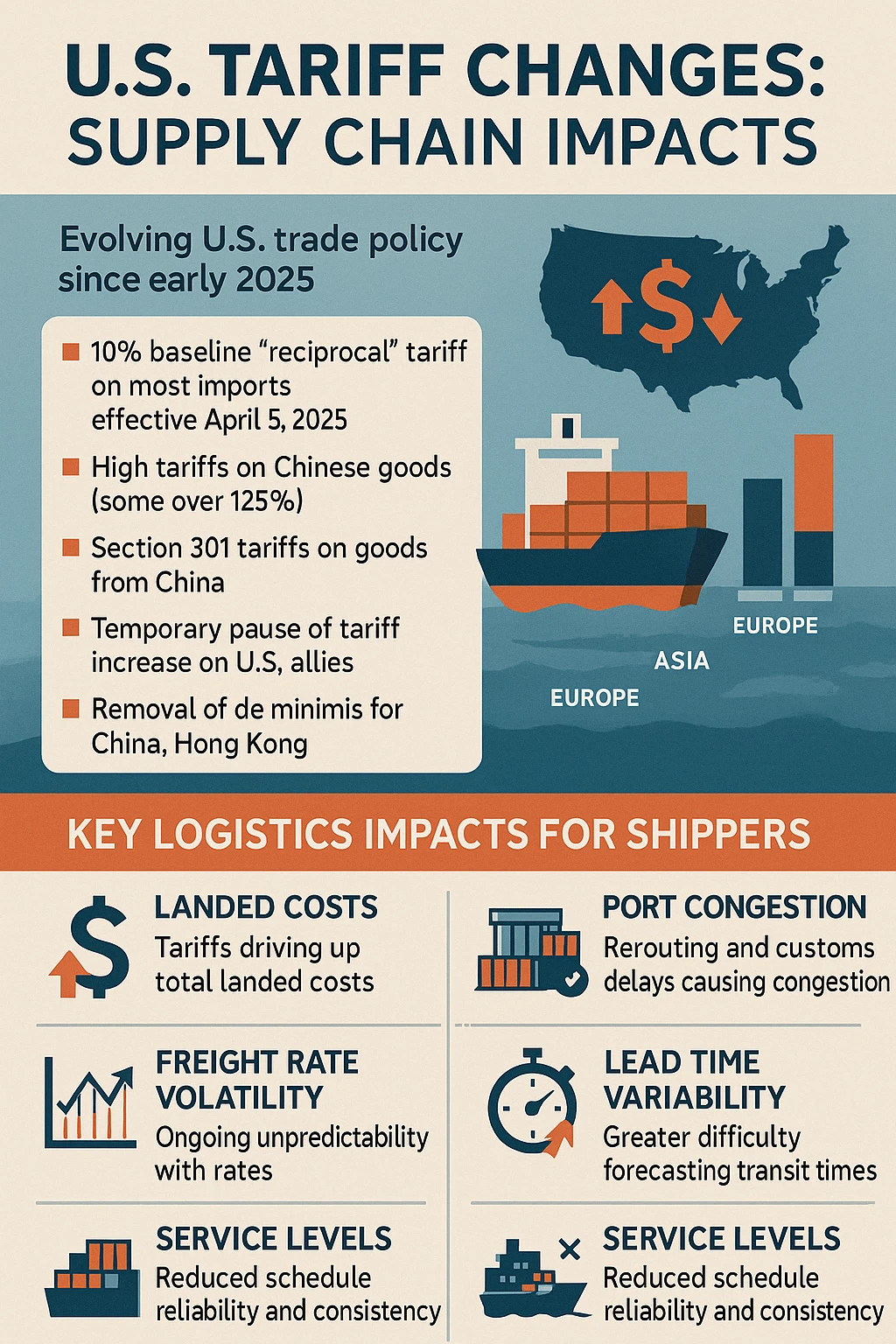

Since early 2025, U.S. trade policy has entered a phase of heightened complexity and volatility.

Key developments include:

- A 10% baseline “reciprocal” tariff now applies to most imports, effective April 5, 2025.

- High punitive tariffs on Chinese goods, with some effective rates exceeding 125%.

- Section 301 tariffs remain in place, particularly targeting goods from China.

- Temporary suspension of higher tariffs on U.S. allies, including the EU, remains uncertain after a 90-day pause.

- Removal of the de minimis threshold for low-value imports from China and Hong Kong.

While trade within North America continues to benefit from USMCA exemptions, imports from Europe and Asia now face a significantly more uncertain and costly landscape.

Key Logistics Impacts for Shippers

This evolving trade framework has several direct and indirect consequences for Shippers with global supply chains:

- Landed Costs: Tariffs are causing a steep increase in total landed costs, particularly on transatlantic and transpacific lanes.

- Port Congestion: Persistent congestion, driven by cargo rerouting and customs backlogs, is affecting port operations globally.

- Freight Rate Volatility: Rates remain unpredictable despite recent market softening, due to rising operating costs and compliance challenges.

- Lead Time Variability: Transit times are increasingly difficult to forecast, requiring more robust inventory planning and safety stock buffers.

- Service Levels: Carriers continue to implement blank sailings and tactical adjustments, impacting schedule reliability and service consistency.

Preparing for the Future: Strategic Scenarios

We have identified three potential trade scenarios to support your logistics and sourcing strategy:

- Protracted High Tariffs & Ongoing Friction (Status Quo+)

- Continued 10%+ tariffs on most imports.

- Persistent congestion and elevated freight rates.

- Moderate sourcing shifts to North America to mitigate costs.

- Escalation and Broad Retaliation (Trade War Intensifies)

- Potential for tariffs of 25–200% on targeted goods.

- Significant rerouting of supply chains, capacity reductions, and volatile freight rates.

- Risk of global demand slowdown and major supply disruptions.

- Gradual De-escalation and Negotiation (Normalization Path)

- Potential rollback of reciprocal tariffs through successful diplomatic negotiations.

- Recovery of EU–U.S. trade lanes and more stable freight markets.

- Improved lead times, cost structures, and service reliability.

Our Recommendations

To mitigate the risks and ensure supply chain resilience, we recommend:

- Diversifying supplier and production networks, especially for U.S.-bound goods.

- Reviewing Incoterms and tariff codes to ensure correct duty application.

- Optimizing inventory management, maintaining buffer stocks where necessary.

- Monitoring trade developments closely, using real-time dashboards and KPIs.

- Engaging in scenario planning to remain agile in the face of changing trade policy.

Looking Ahead

As your logistics partner, we remain committed to helping you adapt to this shifting trade environment. Whether under prolonged friction or gradual normalization, we are prepared to support flexible and cost-effective logistics solutions that align with your business priorities.

We would also like to draw your attention to current developments in the ocean freight market: Several carriers have announced new General Rate Increases (GRIs) and Peak Season Surcharges (PSS) effective mid-May. While the first announcements have been made, it remains uncertain whether all carriers will follow suit and, more importantly, whether these higher cost levels will be successfully implemented across the board. We are closely monitoring these developments and will keep you informed of any material changes that could affect your cost structure or planning.

Please feel free to contact your Account Manager should you have any questions or require tailored support for your specific trade lanes.